The Apple Savings account has generated a lot of attention since its launch. Designed with the iPhone user in mind, it blends technology, ease of use, and financial growth in a sleek package. But how does it really perform compared to traditional banks and other digital savings options? In this review, we’ll break down everything you need to know about the Apple Savings account. We’ll cover how it works, the interest rate, ease of use, pros and cons, and whether it’s a good fit for you.

What Is the Apple Savings Account

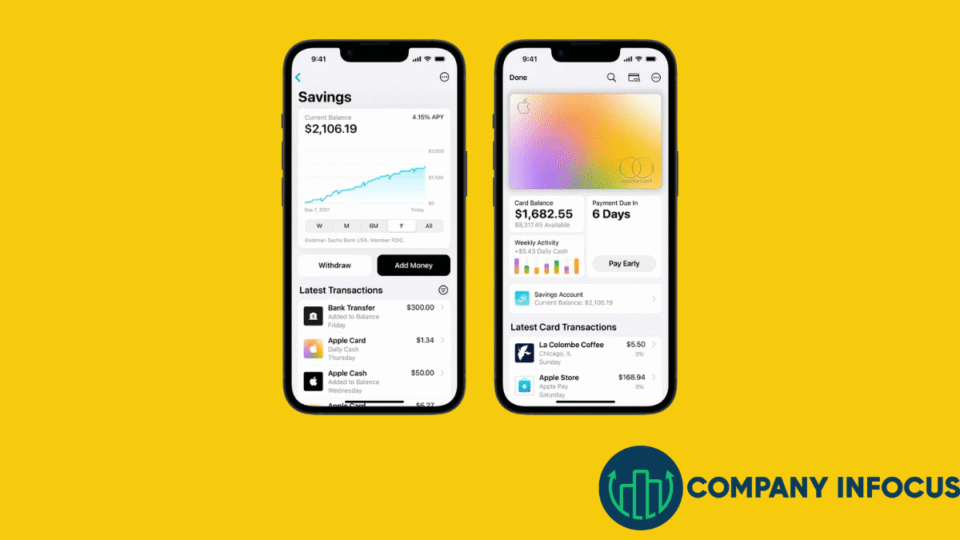

Apple’s savings account is offered in partnership with Goldman Sachs and is available to users who have the Apple Card. It is fully integrated into the Apple Wallet app, making it easy to manage directly from your iPhone. The goal is simple. Apple wants to give users a secure and rewarding way to save the Daily Cash they earn from using the Apple Card. Instead of letting that money sit unused, it can now be stored in a high-yield savings account that earns interest every day.

How the Account Works

To open the Apple Savings account, you need an Apple Card and an iPhone running iOS 16.4 or later. Once your card is set up, you can open the account in just a few taps through the Wallet app. There are no account fees, no minimum balance requirements, and no hoops to jump through. Your Daily Cash automatically deposits into the savings account unless you choose to transfer it somewhere else.

You can also add money to your Apple Savings account from a linked bank account or your Apple Cash balance. You can transfer funds out at any time, and everything is managed inside the Wallet app. It’s not designed for frequent spending or payments. This is strictly a savings tool, and Apple keeps it simple on purpose.

High Interest and Daily Growth

One of the most attractive features of the Apple Savings account is the interest rate. While the exact rate may change, it launched with a highly competitive annual percentage yield. This is several times higher than the national average for traditional savings accounts. Interest is calculated daily and paid monthly, giving users a chance to see their money grow without having to do anything extra.

The interest earned is clearly displayed in the Wallet app. Apple also shows your current balance, recent deposits, and any money you move in or out. It’s transparent, easy to follow, and built for people who want to set it and forget it.

Security and Privacy You Can Trust

Because the account is backed by Goldman Sachs and built into the Apple ecosystem, it comes with strong security features. Your account is protected by Face ID or Touch ID, and your data is never sold or shared with third parties. Apple does not track your savings habits or use your information for advertising. That commitment to privacy sets Apple apart from many other financial apps and digital wallets.

The funds in your Apple Savings account are also insured by the FDIC up to the legal limit. That means your money is just as safe as it would be in a traditional bank account. Combined with the seamless security of your Apple device, it offers peace of mind for tech-savvy savers.

Who the Account Is Best For

This account is not available to everyone. You must have an Apple Card and live in the United States to open one. If you are already deep in the Apple ecosystem and use Apple Pay regularly, this is a great addition. It’s also a smart choice for people who earn a lot of Daily Cash and want to grow it passively without opening another bank account.

It is not ideal for those who use Android devices or do not have the Apple Card. And because it is not designed for daily withdrawals or bill payments, it’s not a full banking solution. Think of it more as a savings tool, not a checking account replacement.

Easy User Experience

The user interface is what you would expect from Apple. Clean, simple, and intuitive. You can check your balance, review your interest, and move money with just a few taps. There is no separate app to download or new platform to learn. It all lives within the Wallet app on your iPhone. That convenience makes it especially appealing to younger users or those who prefer managing everything from their phone.

There are no physical branches, no printed statements, and no live customer support phone number through Apple itself. If you need help, you’ll be directed to Goldman Sachs support. That may be a downside for some users who prefer a more traditional banking experience with personal service.

Pros and Cons at a Glance

The Apple Savings account has several strengths. It offers a high interest rate, zero fees, and a smooth setup process. You can save automatically with your Daily Cash and add extra funds from other sources. The interface is clean, and the account is protected by both FDIC insurance and Apple’s built-in privacy policies.

On the flip side, it’s only available to Apple Card users. You can’t open a joint account, and there’s no way to get paper statements. It’s also limited to personal use, with no business account options. While these trade-offs are reasonable for most people, they’re worth considering if you want more flexibility.

Final Thoughts

The Apple Savings account is a solid option for iPhone users looking to earn more from their Daily Cash rewards. It delivers a rare mix of high interest, no fees, and a user-friendly design. If you’re already using the Apple Card and Wallet app, it’s a smart next step that fits right into your daily routine.

It’s not the only high-yield savings account out there, but it’s one of the easiest to use. And because it’s backed by a trusted name like Apple, many users feel confident letting their savings grow in the background. Whether you’re just starting to save or looking for a better place to park your money, this account is worth a closer look.